osceola county property tax due date

The due date is on the 20th day of the month. The tax collector will mail your first notice of payment due with instructions.

Osceola County Ordinance 00 13 Indian Wells Hoa

Property taxes are due on September 1.

. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. June 1 2020 First Installment Payment Due. File Tourist Tax Return and Pay Taxes.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. Failure to make the first payment will automatically cancel the participant from the plan and the taxpayer will be required to pay the taxes due in full by March 31st. This deferment allows you time to pay your winter taxes between March 1 - April 30 without penalty or interest in anticipation of receiving a homestead property tax refund.

The deadline for submission of your 2021 Tangible Personal Property Tax Return is April 1 2022. Ultimate Osceola County Real Property Tax Guide for 2022. Local Business Tax Receipts become delinquent October 1st and late fee applies.

Winter taxes are due by February 14 without penalty. 4 discount if paid in November. March 1 2023 2022 unpaid taxes go delinquent.

If you have sold this property please forward this notice to the. When paying property taxes by parcel number please enter the 10 digit parcel number which appears in the bottom right corner of either payment stub. If the owner fails to pay hisher taxes a tax certificate will be sold by the Tax Collector.

You can either report at a monthly or quarterly frequency. Property taxes are due on september 1. All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest.

3 discount if paid in December. March 31 Full amount due on Real Estate and Tangible Personal Property Taxes. Issued Dec 2022 Due by Feb 14 2023.

Tangible Personal Property Returns Due. Taxes become delinquent on April 1st of each year. 2021 OSCEOLA COUNTY PROPERTY TAX 1.

The following discounts are applied for early payment. Osceola county property appraiser attn. Full amount due on property taxes by March 31st.

Osceola County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Payments accepted after June 30th but before July 30th are not discounted. Assessment Valuation End Date.

Issued July 2022 Due by Sept 14 2022 Winter Tax. If you dont pay by the due date you will be charged a penalty and interest. Receive 1 discount on payment of real estate and tangible personal property taxes.

The tax return form is here. The gross amount is due by March 31st of the following year. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes.

Deadline to File for Exemptions. Learn how Osceola County levies its real property taxes with our detailed review. Failure to file your TPP Return by the deadline is subject to penalty per Florida Statute 193072.

If you are considering becoming a resident or only. Remember to have your propertys Tax ID Number or Parcel Number available when you call. New applicants must report monthly for the first year.

These taxes are due Monday February 28 2022 by 500pm. 1 discount if paid in February. The plan requires that the first installment must be made no later than June 30th to receive a discount.

Current Tax Due Dates Summer Tax. Real estate taxes become delinquent each year on April 1st. Property owners are required to pay property taxes on an annual basis to the County Tax Collector.

March 31 Fourth 4th and final Installment Payment Due on 2019 Taxes. Summer taxes are due by September 14 without interest. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart.

Know the tourist development tax due dates to avoid penalities. If you have documents to send you can fax them to the Osceola County assessors office at 407-742-4900. Please take a minute to carefully examine the information on the enclosed tax notice and verify the following information.

Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. What is the due date for paying property taxes in Osceola county. 2 discount if paid in January.

April 30 2020 Installment Plan Applications Deadline. Application If you qualify please fill out an Application for Deferment of Winter Taxes pdf and return the application and a copy of your MI-1040 CR to the following address before April 30th. Osceola County collects on average 095 of a propertys assessed fair market value as property tax.

Process of unpaid taxes. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Search all services we offer.

The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value. Please call the assessors office in Kissimmee before you send. Valorem taxes for the fiscal year October 1 2021 through September 30 2022.

You can call the Osceola County Tax Assessors Office for assistance at 407-742-5000. After 500pm After this time all unpaid taxes will be sent as delinquent to the Livingston County Treasurer. March 1 2024 2022 unpaid taxes go into forfeiture.

Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Learn all about Osceola County real estate tax. Receive a 3 discount on payment of real estate and tangible personal property taxes.

OWNERSHIP Are you still the current owner of the property. If you would like to pay when we are closed or prefer not to come inside we have a walk-up secured drop box that is located to the right of the main entrance doors on the front side of our building. Gross amount paid in March no discount applied.

Real Estate And Tax Data Search Fond Du Lac County

Initial Registration Fee Exemption Affidavit Osceola County Tax

For Osceola County Florida Pdf Free Download

Distrito Escolar Del Osceola County School District

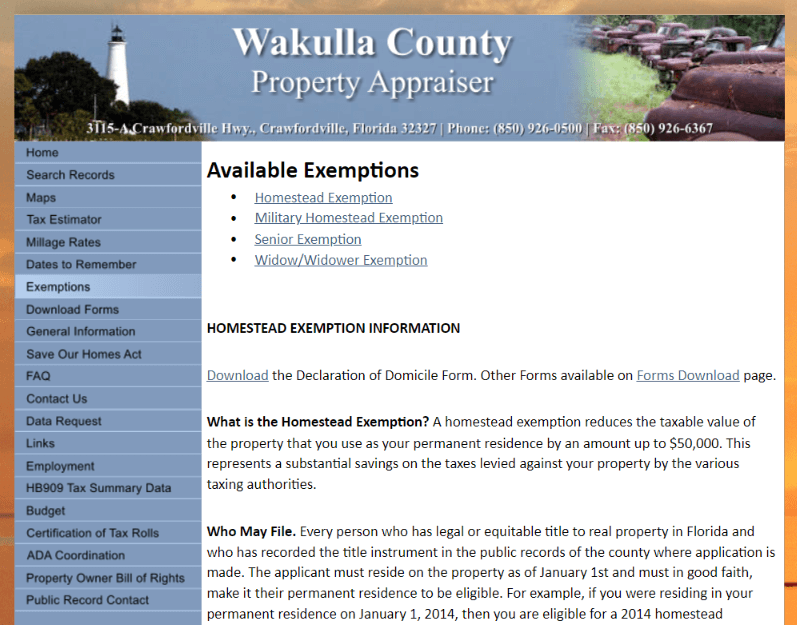

Wakulla County Property Appraiser How To Check Your Property S Value

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

For Osceola County Florida Pdf Free Download

Initial Registration Fee Exemption Affidavit Osceola County Tax

Job Opportunities Osceola County Job Center

Osceola County Ordinance 00 13 Indian Wells Hoa